MBABANE – The micro, small and medium enterprises (MSMEs) sector has welcomed the Central Bank of Eswatini’s latest monetary policy stance.

The sector described it as broadly supportive of business growth at a time when access to finance remains one of the most pressing challenges facing local entrepreneurs.

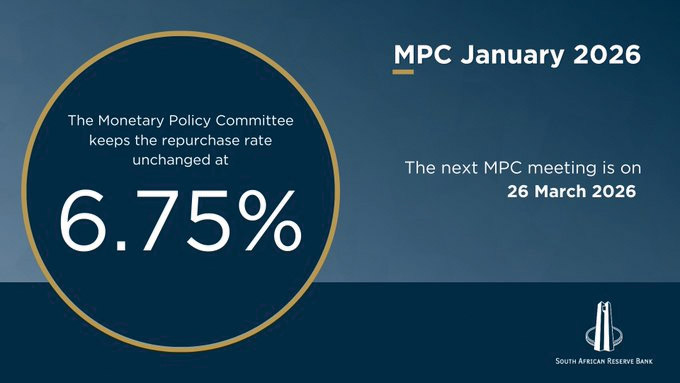

Reacting to the Central Bank of Eswatini’s (CBE) Monetary Policy Statement delivered by Governor Dr Phil Mnisi last Friday, Business Federation of Eswatini (BUFE) President Thulisile Dladla said the decision to maintain the discount rate at 6.75 per cent provides a relatively stable and predictable environment for MSMEs, which are often the most sensitive to changes in borrowing costs.

“The CBE monetary policy statement has a very significant influence on MSME borrowing and growth,” Dladla said.

“For us as the MSME sector, stability in interest rates, coupled with low inflation and stronger GDP growth, creates a generally supportive environment for doing business.”

The Central Bank maintained the discount rate at 6.75 per cent following its January meeting, a move that was widely expected given Eswatini’s currency peg to the South African Rand and the South African Reserve Bank’s (SARB) decision a day earlier to keep its repo rate unchanged.

Commercial banks are, therefore, expected to maintain the prime lending rate at 10.25 per cent until the next monetary policy review.

According to Dladla, this policy consistency is particularly important for small businesses that already operate under tight cash flow conditions and limited financial buffers.

“Most MSMEs struggle to acquire capital because they are often labelled unbanked and risky by banks,” she said.

*…

… low, stable inflation protects consumers’ purchasing power

MBABANE - Low and stable inflation plays a crucial role in protecting the purchasing power of consumers, which in turn supports demand for goods and services produced by small businesses.

“When inflation is low, consumers are better able to spend and that supports MSMEs across retail, services and manufacturing,” BUFE President Thulisile Dladla said. “It also helps businesses plan better because costs are more predictable.”

The supportive policy environment is further reinforced by Eswatini’s improving economic performance. The country’s economy grew by 5.6 per cent in 2025, up from 3.0 per cent in 2024, with broad-based growth recorded across the primary, secondary and tertiary sectors.

On a quarterly basis, GDP expanded by 5.8 per cent year-on-year in the third quarter of 2025, signalling sustained economic momentum. Dladla said stronger GDP growth creates opportunities for MSMEs to expand, invest and create jobs, provided that financing conditions remain conducive.

“If the discount rate and prime lending rate are reduced or maintained, borrowing becomes more affordable for MSMEs,” she said. “This encourages investment, expansion and ultimately, employment creation.” She emphasised that MSMEs are a critical pillar of the Eswatini economy, contributing significantly to job creation, income generation and innovation. However, their potential can only be fully realised if financial systems are responsive to their needs.

While welcoming the current policy stance, BUFE reiterated its call for continued engagement between policymakers, financial institutions and the private sector to address structural barriers to MSME financing.

*Full article available on Pressreader*