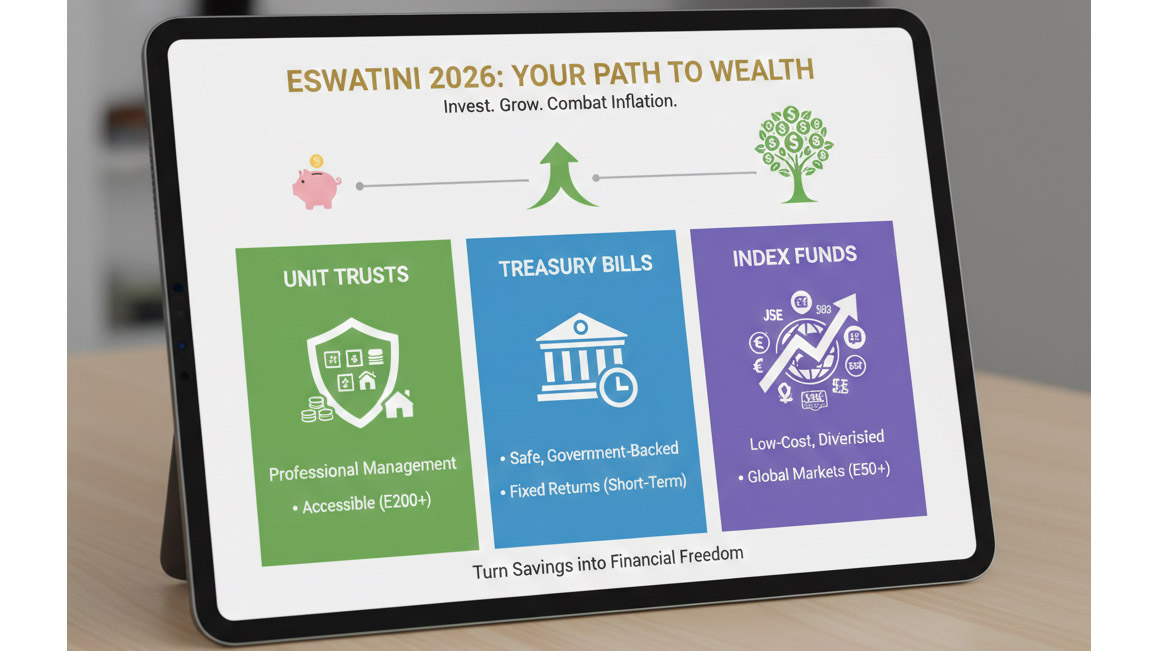

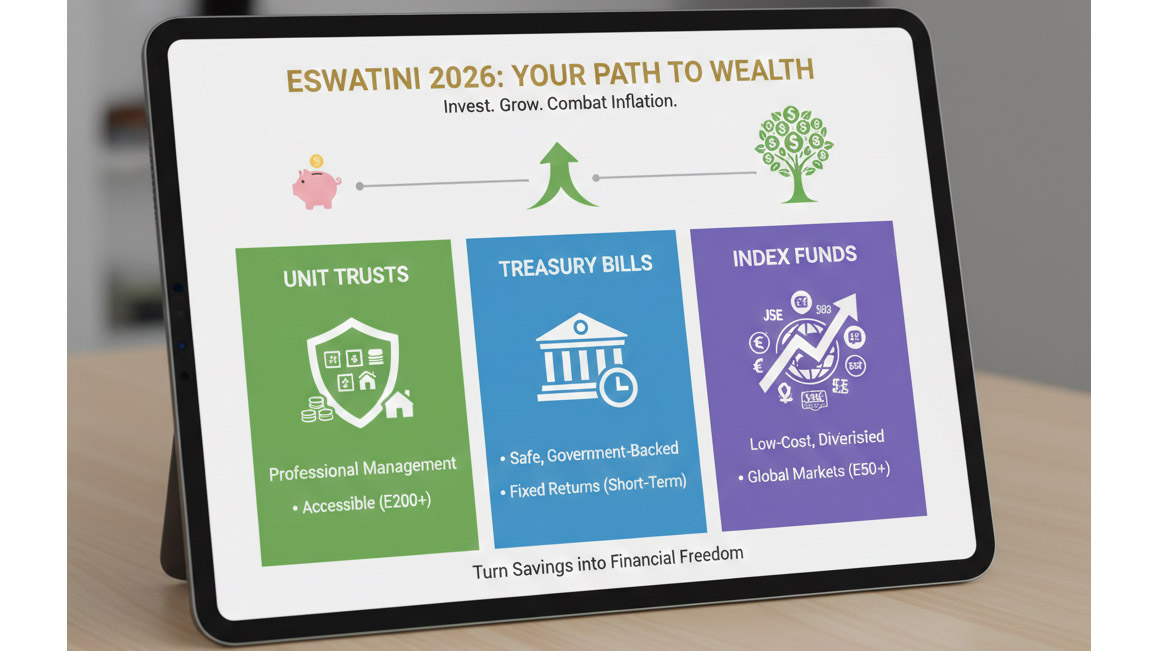

As we wrap up our investment and savings series, it’s time to shift our gaze from the foundational principles of budgeting and saving, discussed in January to the next logical step: Growing your money. For many people, the idea of investing still feels distant, reserved for the wealthy or financially savvy. However, the truth is, with the right tools and mindset, anyone can begin building wealth. Today, we explore three accessible and powerful investment vehicles: Unit trusts, treasury bills and index funds.

Saving is essential but it’s not enough. Inflation quietly erodes the value of idle cash. If your money is sitting in a low-interest savings account earning 3 per cent while inflation is running at 5 per cent, you’re effectively losing purchasing power. That’s where investing comes in. It’s not about gambling or chasing quick wins; it’s about putting your money to work in a way that aligns with your goals, risk tolerance and time horizon.

Let’s unpack three options that are particularly relevant for ordinary emaSwati looking to grow their wealth steadily and responsibly.

Unit trusts are pooled investment vehicles managed by professionals. When you invest in a unit trust, your money is combined with that of other investors and spread across a diversified portfolio via stocks, bonds, property or a mix of all three.

Unit trusts are worth considering for several reasons. First, they offer accessibility, you can start investing with as little as E200 or E500, depending on the provider.

Second, they provide diversification by spreading your risk across multiple assets, which helps reduce the impact of any single poor performer. Lastly, they offer professional management, meaning fund managers make investment decisions on your behalf, which is especially beneficial for individuals who lack the time or expertise to manage their own portfolios.

When investing in unit trusts, there are a few important cautions to keep in mind. Firstly, fees can significantly affect your returns; management and performance fees may seem small but can accumulate over time, so it’s essential to read the fine print carefully.

Secondly, while historical performance can offer some insight, it is not a guarantee of future results. It’s wise to choose funds with a consistent track record and a clearly defined investment strategy to align with your financial goals.

In the kingdom, unit trusts are offered by reputable financial institutions like Stanlib, Old Mutual and African Alliance. They’re a great entry point for first-time investors who want exposure to markets without the complexity of picking individual stocks.

If you’re looking for a low-risk, short-term investment, treasury bills (T-bills) are worth your attention. Issued by the Central Bank of Eswatini, T-bills are essentially loans you give to government for a fixed period usually 90, 180 or 364 days in exchange for interest.

Treasury bills offer several compelling advantages for conservative investors. Their primary appeal lies in their safety, since they are backed by government, they are considered one of the most secure investment options available.

Additionally, they provide predictable returns, as the interest is known upfront, making them ideal for those with short-term financial goals or a low-risk appetite. While they are not as liquid as a regular savings account, T-bills typically mature in less than a year, allowing relatively quick access to your funds when needed.

While T-bills offer safety and predictability, there are a few important considerations to keep in mind. First, their returns are generally lower compared to equities or unit trusts, reflecting the trade-off for reduced risk.

Secondly, access can be a hurdle for individual investors, as the market is largely dominated by institutions. However, individuals can still participate through licensed brokers or by bidding directly in the Central Bank’s auction system. Despite these limitations, T-bills remain an excellent option for parking funds you may need in the near future such as for school fees or a home deposit while earning more than a typical savings account.

Index funds are a type of unit trust or exchange-traded fund (ETF) designed to replicate the performance of a specific market index, such as the JSE Top 40 or the S&P 500. Rather than attempting to outperform the market, these funds aim to mirror it.

They are attractive for several reasons. Firstly, they come with low fees because they are passively managed, making them more cost-effective than actively managed funds. Secondly, they offer consistent performance over the long term; index funds often outperform many actively managed alternatives. Thirdly, they provide global exposure, allowing investors to diversify beyond Eswatini and South Africa by accessing international markets.

Index funds carry market and currency risks, making them better suited for long-term goals like retirement. Despite these risks, platforms like EasyEquities and Satrix enable emaSwati to start investing from as little as E50. For young investors, they offer an affordable, accessible path to steady wealth accumulation over time.

Start investing with intention, no matter your income, begin small, stay consistent and diversify wisely. Wealth grows through discipline and action, turning savings into long-term financial freedom.

Saving is essential but it’s not enough. Inflation quietly erodes the value of idle cash.