MBABANE – Household borrowing in Eswatini continued its upward trajectory towards the end of 2025, with unsecured lending remaining a key driver.

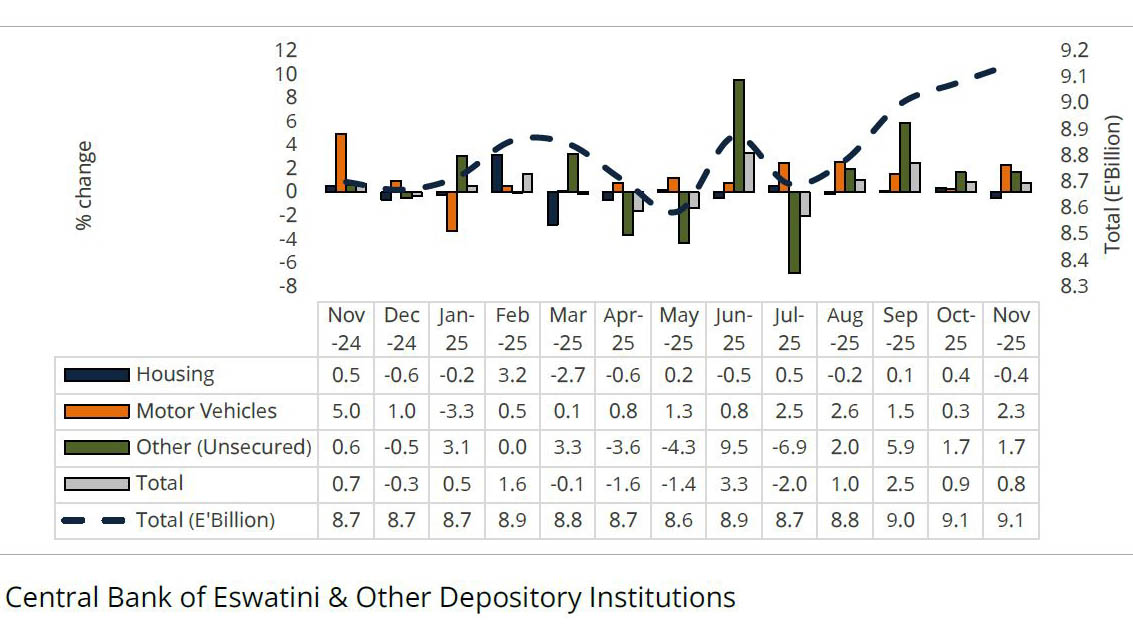

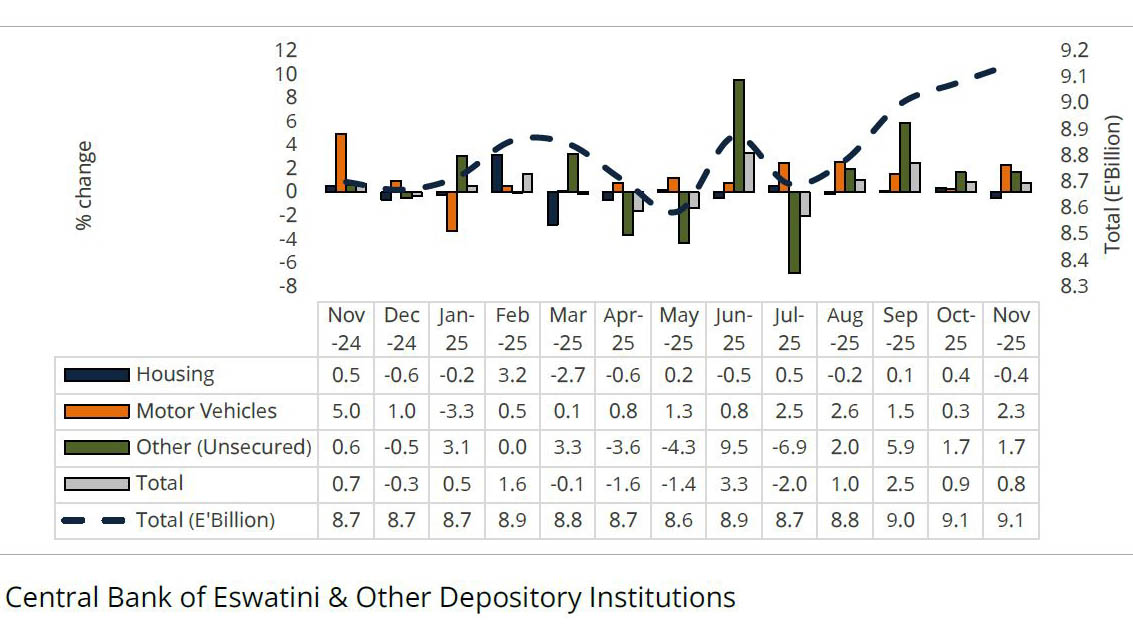

According to the Central Bank of Eswatini’s (CBE) Recent Economic Developments (RED) report for November–December 2025, credit extended to households and non-profit institutions serving households (NPISH) grew marginally by 0.8 per cent month-on-month and by 5.2 per cent year-on-year to reach E9.1 billion in November 2025.

The increase was largely underpinned by growth in unsecured lending, reflecting sustained reliance on credit by households amid cost-of-living pressures and constrained disposable incomes.

Motor vehicle loans rose by 2.3 per cent month-on-month to E1.4 billion, signalling continued demand for consumer durables despite broader economic uncertainties.

At the same time, other personal loans – predominantly unsecured – increased by 1.7 per cent to E3.6 billion, further highlighting the growing role of unsecured borrowing in household financing.

The Central Bank noted that while overall household credit growth remains moderate, the composition of lending warrants close monitoring due to its implications for financial stability, particularly in an environment of elevated interest rates and inflationary pressures.

Encouragingly, the banking sector asset quality showed signs of short-term improvement during the period under review. Non-performing loans (NPLs) declined by 3.5 per cent month-on-month to E1.3 billion at the end of November 2025.

However, on an annual basis, NPLs remained elevated, increasing by 6.0 per cent compared to November 2024, suggesting that underlying credit risk persists within the system.

As a result of the monthly improvement, the NPL ratio declined by 0.3 percentage points month-on-month and by 0.2 percentage points year-on-year to settle at 6.9 per cent.

While the decline is a positive development, the CBE cautioned that the ratio remains relatively high, particularly against the backdrop of rising unsecured household lending.

*…

Net foreign assets record solid growth

MBABANE – On the external front, Eswatini’s net foreign assets (NFAs) recorded a robust performance in November 2025, providing some cushioning against broader external pressures.

NFAs stood at E15.0 billion at the end of November, reflecting a strong increase of 15.8 per cent month-on-month and 27.2 per cent year-on-year. The growth was driven by improvements in both the banking sector and the official sector.

NFAs of the banking sector rose sharply by 60.7 per cent month-on-month and 19.4 per cent year-on-year to E2.6 billion, largely due to higher deposits held within the Common Monetary Area (CMA) and abroad.

Similarly, the official sector’s NFAs expanded by 9.5 per cent month-on-month and 28.9 per cent year-on-year to E12.4 billion, supported by increased foreign currency inflows from trades with local banks.

In Special Drawing Rights (SDR) terms, Eswatini’s NFAs rose to SDR643.2 million, reflecting an increase of 17.1 per cent month-on-month and 30.5 per cent year-on-year.

Despite the positive NFA developments, Eswatini’s gross official reserves came under significant pressure in December 2025. Provisional reserves declined sharply by 26.2 per cent month-on-month to E11.4 billion, according to the RED report.

The Central Bank attributed the contraction mainly to net foreign currency outflows arising from trades with commercial banks, coupled with the payment of government external obligations during the month.

Although reserves were 12.9 per cent higher on a year-on-year basis, the sharp monthly decline weakened the country’s external buffer and led to a notable deterioration in import cover.

Import cover fell from 3.6 months in November 2025 to 2.7 months in December, dropping below the commonly recommended minimum threshold of three months. Preliminary figures show that total public debt stood at E40.2 billion equivalent to 41.8 per cent of GDP, as at, the end of December 2025.

*Full article available on Pressreader*

copy.jpg)