MBABANE - Coal output fell by 31.5 per cent, on a year-on-year comparison, in the first quarter of 2025, reflecting weak demand from South Africa’s steel industry.

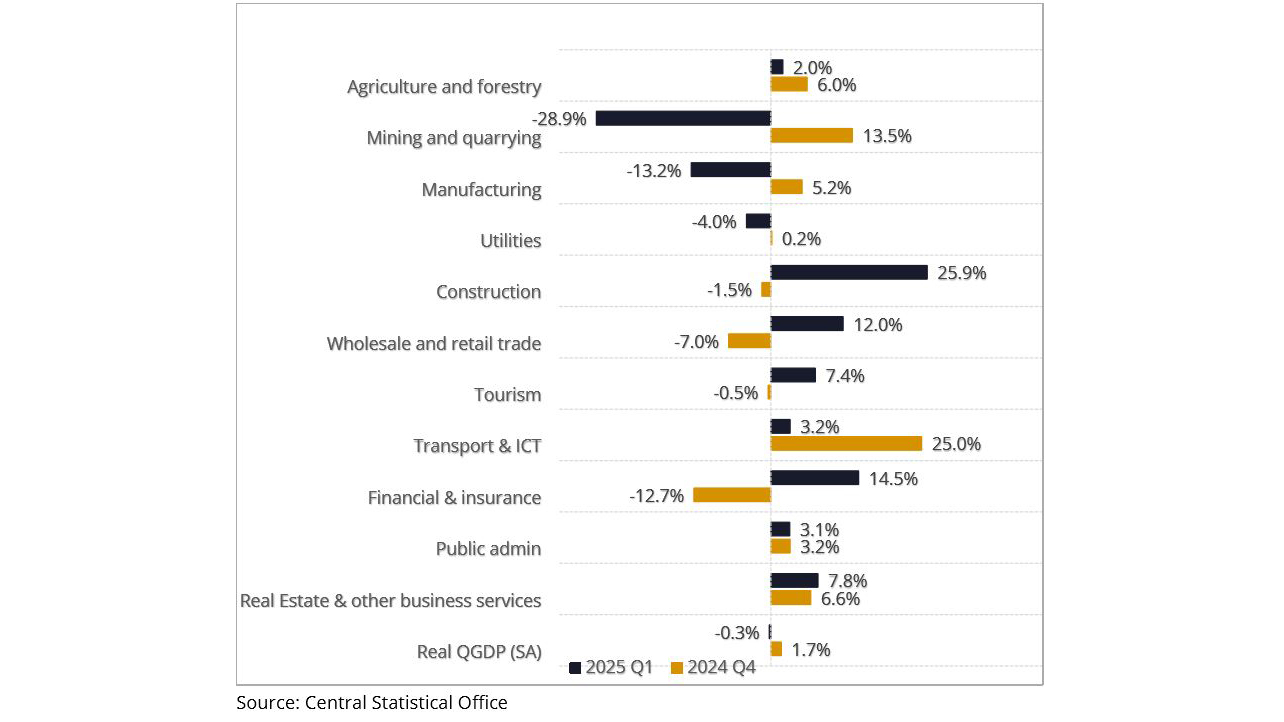

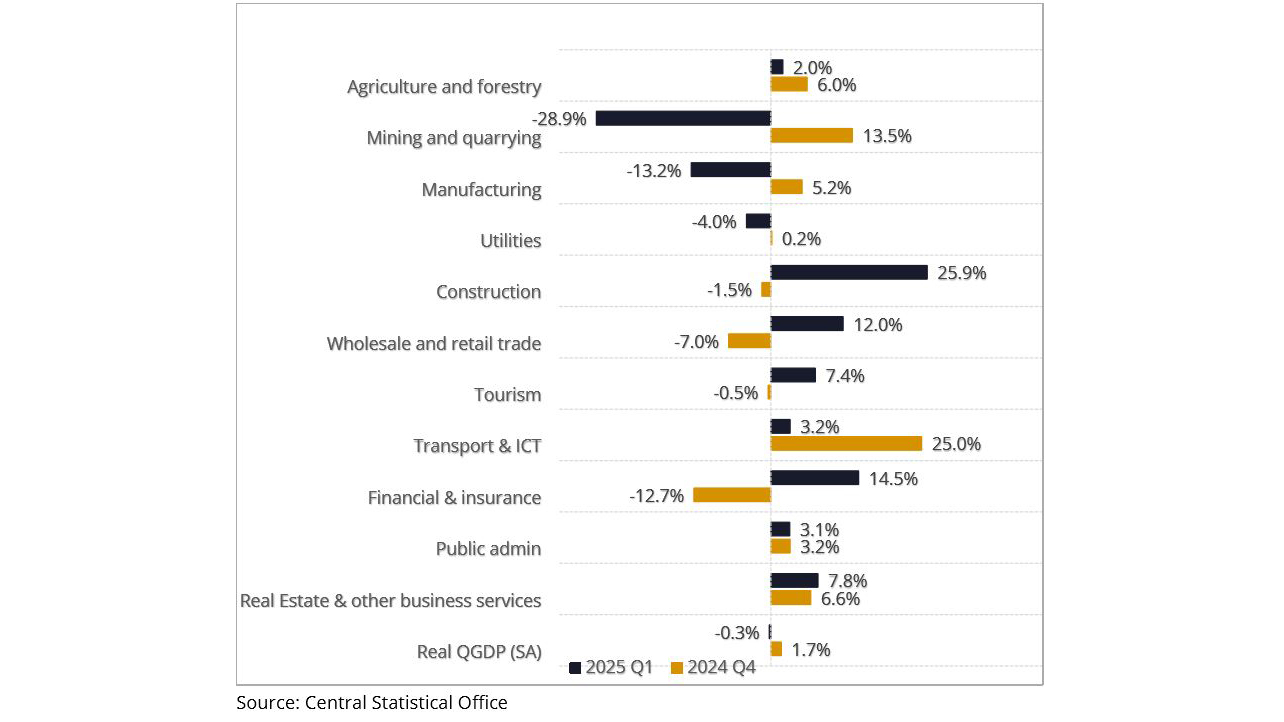

This is according to the Central Bank of Eswatini’s Recent Economic Developments (RED) report for June–July 2025. The decline in coal production formed part of a broader contraction in the mining sector, which slumped 28.9 per cent in the quarter under review. The RED report attributed the downturn to temporary stoppages in South Africa’s steel industry, which slowed demand for Eswatini’s coal exports.

The drop in mining was a key driver of subdued economic activity, as real gross domestic product (GDP) fell by 0.3 per cent year-on-year (seasonally adjusted) in the first quarter of 2025, compared to a revised growth of 1.7 per cent in the final quarter of 2024.

It is worth noting that the impact of the coal output reduction has already been felt, as it has reportedly forced Maloma Colliery Limited to retrench its operations, as 14 smelters shut down their plants in the neighbouring republic.

The smelters shut down their operations due to the high electricity tariffs, claiming these have made it impossible to operate their businesses.

This has lessened the demand for coal as there are minimal clients to supply and forcing the country’s leader in anthracite coal mining to remodel its business.

Maloma Colliery Limited’s clientele entails smelters, who need the coal for two main purposes: Providing heat and acting as a reducing agent.

Coal is burnt to generate the high temperatures necessary to melt the ore and it also provides the carbon monoxide that strips oxygen from the iron ore, leaving behind usable iron.

Given that their operations are suspended, Maloma Colliery Limited’s Chief Executive Officer (CEO) Jabulile Shabangu said what has affected their South African market is the increase in electricity costs and the introduction of an export tax.

Shabangu said the high electricity costs are severely impacting South Africa’s smelters, making them uncompetitive and leading to production cuts, smelter closures and increased export of raw materials.

She said this follows that electricity is a major input cost for them (smelters) and the recent price hikes have eroded profit margins and threatened the viability of these energy-intensive operations.

In fact, Shabangu’s assertions align with a report by Reuters, an international news agency, which reported on July 3, 2025, that South Africa’s proposed chrome ore export tax will hurt miners’ profitability and lead to job losses across the sector.

The online news publication attributed this challenge to South Africa’s Minerals Council. It reported that South Africa is the world’s biggest exporter of chrome, which is mostly used in the manufacture of stainless steel. Consequently, the high electricity tariffs, being the biggest global producer of ferrochrome, a combination of chrome and iron, led to the loss of the pole position to China.

These high electricity tariffs, which are an operational cost, were reported to have forced many smelters to shut down.

Full article available in our publication.

No more rushing to grab a copy or missing out on important updates. You can subscribe today as we continue to share the Authentic Stories that matter. Call on +268 2404 2211 ext. 1137 or WhatsApp +268 7987 2811 or drop us an email on subscriptions@times.co.sz